About the Client

We started work with an advanced blockchain incipiency who had a specific request for a smart contract result from its biggest client. The end customer was one of the oldest and largest insurance companies in Europe who also was an active member of the International Cooperative and Mutual Insurance Federation( ICMIF). The company employs about,000 professionals across Europe and holds leading positions in the Dutch insurance industry.

This end customer delivers substantially health,non-life, and income protection insurance products. Although the company’s roots date back to the early nineteenth century, their seeking for nonstop invention makes them a competitive player in the ultramodern digital insurance request.

As an honoured InsurTech enabler, the company is pushing invention at every possible position, moving outside traditional insurance and forestallment services and offering disruptive blockchain technology results and IoT- powered web and mobile results.

Our Client came with the challenge

The end customer recently joined the Blockchain Insurance Industry Initiative( B3I), whose crucial charge is to transfigure the insurance sector and make insurance more affordable and accessible for consumers. With a Blockchain- powered ecosystem at the heart of this cooperative trouble, B3I members want to assess the eventuality of distributed tally technologies.

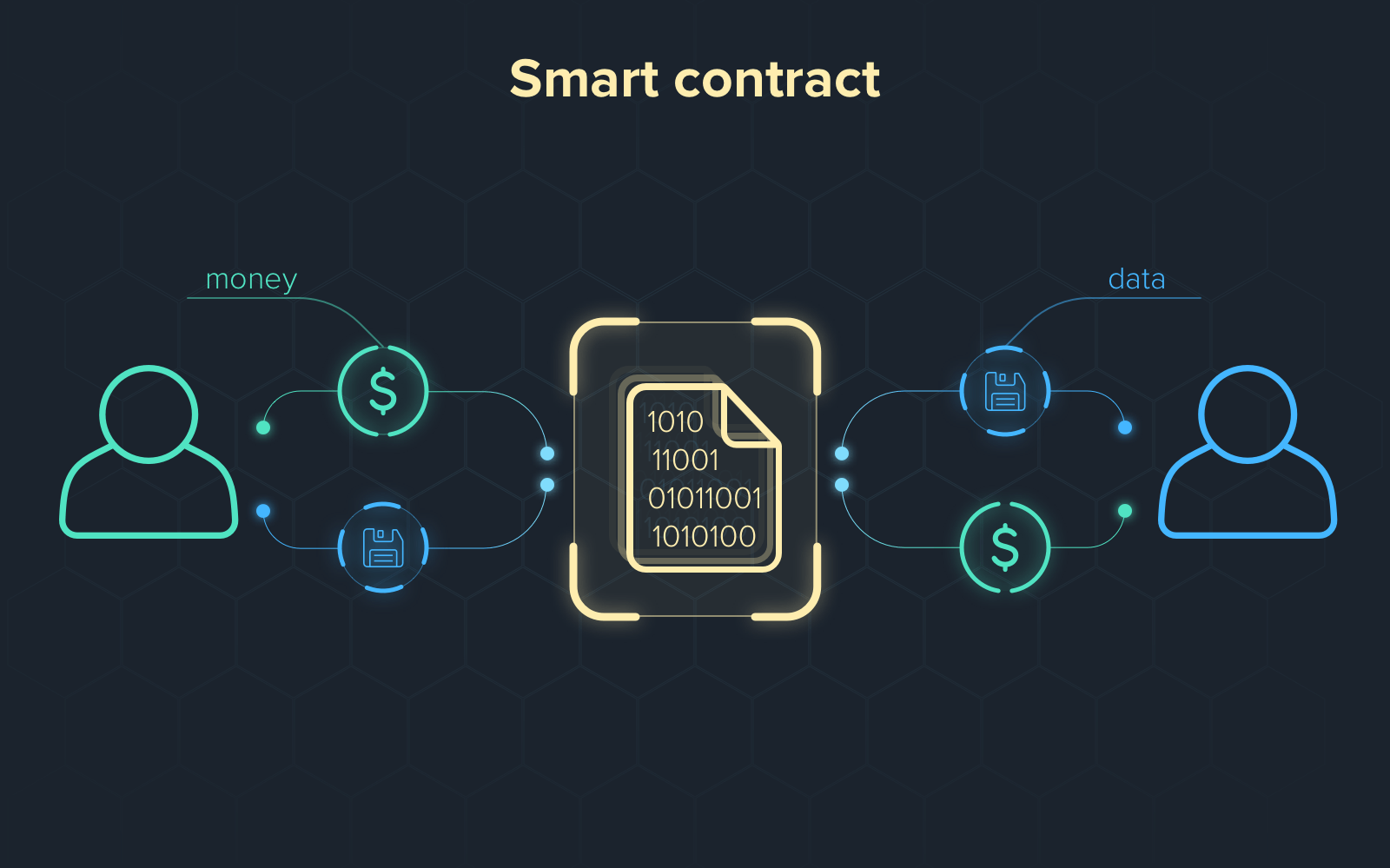

Exploring the blockchain as a way to help insurance fraud and maximise continuity and resistance to attack, the end customer launched an airman design in cooperation with a Swiss blockchain incipiency who was our direct customer. This Swiss mate delivers a suite of largely scalable smart contract results including a language for defining contract specifications and an operating system for managing and storing smart contracts.

The end customer wanted a prototype web app that would enable online vehicle insurance policy purchases. Each stage in the process, from opting an insurance plan to paying for it, would be stored, streamlined, and validated on the blockchain. Working alongside the end customer and our Swiss mate,Winklix, a dependable insurance software development company, played the part of core frontend design and development provider.

Winklix developed the result

The end customer presented a comprehensive portfolio of conditions, mockups, and use cases at the inauguration phase. Their original vision was to use pure HTML, CSS, and JavaScript as the foundation. Our devoted platoon, still, brought this content up for rigorous discussion, and after a series of pro and con shops we reached a collective agreement.

We agreed to use AngularDart, an infrequently used Google- maintained web app frame that, along with performance and productivity, offers ample openings for exercise. In particular, when combined with Flutter, it allows us to convert web apps into release-ready mobile apps for both Android and iOS with minimal cost and trouble. Although AngularDart experts were nearly insolvable to find on the request, two of our Ruby on Rails masterminds held enough Dart moxie for the design to move forward.

Another matter that Winklix raised was advancements to the stoner experience and product interface. Our UI/ UX design office anatomized and significantlyre-worked the raw prototypes handed by our customer. Special attention was paid to the end customer’s brand integrity, and the UI design followed strict branding conditions across runners.

With the technology mound and UX/ UI design agreed upon,Winklix masterminds moved on to a ferocious development phase. We enforced sense for stoner enrollment and onboarding, dashboards for viewing insurance history and product details, and insurance and claim request features. There were many challenges along the way.

The first was related to the novelty of the AngularDart technology. Our masterminds performed R&D conditioning to resolve issues blocking our point perpetration plan. The alternate challenge was due to the absence of working contract APIs from the end customer, who only handed a verified API specification. Our platoon wriggled out of this situation by incorporating mock objects into both service sense and our functional tests to mimic the geste of a missing API. This workaround allowed us to guarantee zero problems for the customer when integrating our frontend with their blockchain middleware.

We ’re achieving great results together

In less than two months, our platoon has delivered a completely functional web app frontend prototype, exceeding the end customer’s original prospects. The prototype will be integrated with the blockchain- powered middleware developed by our Swiss mate’s platoon. Once completed, we anticipate a major product rally to engage the end customer’s top operation and implicit customers.However, Winklix will be offered an extended product development agreement for a number of blockchain- grounded InsurTech results, If the rally goes well.

Winklix ’ devoted platoon services have brought these benefits to the end customer

- Access to our,1000 in- house masterminds and,1000 masterminds on the Ukrainian gift request

- Easy administration with all contracts, payroll operations, platoon setup, and further covered by Winklix

- Great structure with ultramodern office structures that promote creative and inspiring work

- Delivery Operation including platoon productivity criteria and product quality covering

- Consulting services to identify weak points and establish an nimble metamorphosis action plan

- gift operation to help transfer product knowledge and align remote brigades with the end customer’s in- house platoon