Right now, video streaming dominates the globe, and every industry is eager to adopt it. Not all businesses, though, can use this to increase their operations. Many issues arise from the absence of encoded videos, necessitating the use of AWS Elemental MediaLive. The lack of video file processing and on-demand videos also adds to the difficulties.

Does faulty video streaming affect your company as well? As an entrepreneur, you can require the assistance of both media live and AWS Elemental MediaConvert. It will improve a company’s ability to transmit encrypted videos, live and online streaming, and high-quality videos, among other things.

How does AWS Elemental MediaConvert work?

Elements of AWS Broadcast-quality features are available through the transcoding tool MediaConvert. Video-on-demand (VOD) content creation is a specialty of AWS. It also enables your company to share multimedia material widely. MediaConvert is completely dependable and straightforward to use with pay-as-you-go pricing.

AWS Elemental MediaConvert DRM may be necessary for your company to encrypt video material. To provide content encryption, Digital Rights Management (DRM) delivers keys to the AWS MediaConvert service. AWS Elemental MediaConvert offers three implementation options, including DRM.

Key Features of AWS Elemental MediaConvert

- Flexibility: MediaConvert supports a wide range of video codecs, containers, and formats, giving you the flexibility to create content optimized for various devices and streaming scenarios.

- Scalability: With AWS MediaConvert, you can process multiple files simultaneously, making it a suitable choice for high-volume video processing tasks.

- Customization: It offers a rich set of options for customizing video and audio settings, allowing you to achieve the desired quality and compression levels.

- Automated Workflows: You can integrate MediaConvert into your workflows using AWS Step Functions, enabling automated video processing pipelines.

- Content Protection: AWS Elemental MediaConvert supports content encryption, watermarking, and DRM (Digital Rights Management) to secure your content.

What is Amazon Web Services Elemental MediaLive?

AWS Elemental MediaLive is a useful video processing solution that aids in producing high-quality video streams. Encoding online/live video streams is how this comprehensive AWS solution functions. Additionally, it is advantageous for your company to reduce the movie size into smaller copies for proper dissemination. You can use it to set up and manage live streams or channels that are active 24/7/365.

Modern technology is constantly growing and improving. In a similar vein, 2022 has seen a significant surge in video streaming. AWS Elemental MediaLive RTSP is now accessible to businesses like yours. AWS media live service is currently supported by this Real-Time Streaming Protocol (RTSP).

Key Features of AWS Elemental MediaLive

- Real-Time Encoding: MediaLive provides low-latency encoding for live video streams, making it suitable for applications that require minimal delay, such as live sports or news broadcasting.

- Adaptive Bitrate Streaming: It supports adaptive streaming formats like HLS and DASH, ensuring optimal quality for viewers on varying network conditions.

- Integration: MediaLive seamlessly integrates with other AWS services like AWS Elemental MediaPackage and AWS Elemental MediaConnect, creating a comprehensive live video workflow.

- Statistical Multiplexing: MediaLive uses statistical multiplexing to optimize bitrate allocation, improving video quality while conserving bandwidth.

- Channel Management: You can create and manage multiple channels for different live events, each with its own encoding settings.

Difference Between AWS Elemental MediaLive and AWS Elemental MediaConvert?

AWS Elemental MediaLive and AWS Elemental MediaConvert are two distinct services offered by Amazon Web Services (AWS) for video processing and transcoding. While they both play roles in video workflows, they serve different purposes and have different features. Here’s a breakdown of the key differences between AWS Elemental MediaLive and AWS Elemental MediaConvert:

- Primary Purpose:

- AWS Elemental MediaLive: MediaLive is primarily designed for live video encoding and streaming. It is used to create high-quality live video streams for delivery to various devices and platforms in real time. Common use cases include live broadcasts, sports events, webinars, and live streaming of events.

- AWS Elemental MediaConvert: MediaConvert, on the other hand, is focused on file-based video transcoding and processing. It is used for converting video files from one format to another, applying various transformations, and preparing videos for on-demand playback. Common use cases include video-on-demand (VOD) services, video editing, and content preparation for distribution.

- Input Source:

- AWS Elemental MediaLive: Typically takes a live video input source, such as a camera feed or a live event stream.

- AWS Elemental MediaConvert: Accepts file-based input sources, which can be video files stored in Amazon S3 or other sources.

- Output Formats:

- AWS Elemental MediaLive: Primarily outputs live video streams in various formats suitable for real-time streaming, including adaptive bitrate streaming formats like HLS and DASH.

- AWS Elemental MediaConvert: Supports a wide range of output formats for on-demand video playback, including different video codecs, containers, and packaging options.

- Real-time vs. Batch Processing:

- AWS Elemental MediaLive: Operates in real-time and is optimized for low-latency live streaming applications.

- AWS Elemental MediaConvert: Performs batch processing, making it suitable for offline video transcoding and more complex video processing tasks.

- Content Packaging:

- AWS Elemental MediaLive: Typically doesn’t handle packaging for on-demand delivery; it focuses on live streaming. Packaging may be handled by other AWS services like AWS Elemental MediaPackage or AWS Elastic Transcoder.

- AWS Elemental MediaConvert: Can generate packaged content for on-demand delivery, including creating adaptive bitrate streaming formats

- Integration with Other Services:

- AWS Elemental MediaLive: Often integrated with AWS Elemental MediaPackage, AWS Lambda, and AWS CloudFront for end-to-end live streaming solutions.

- AWS Elemental MediaConvert: Works seamlessly with other AWS services, including Amazon S3, Amazon CloudFront, AWS Step Functions, and AWS Lambda, for creating comprehensive video processing workflows.

- Pricing Model:

- AWS Elemental MediaLive: Typically billed based on the number of channels and the duration of encoding, with separate charges for data transfer.

- AWS Elemental MediaConvert: Billed based on the duration of video processing, the resolution of outputs, and any additional features or add-ons used.

Conclusion

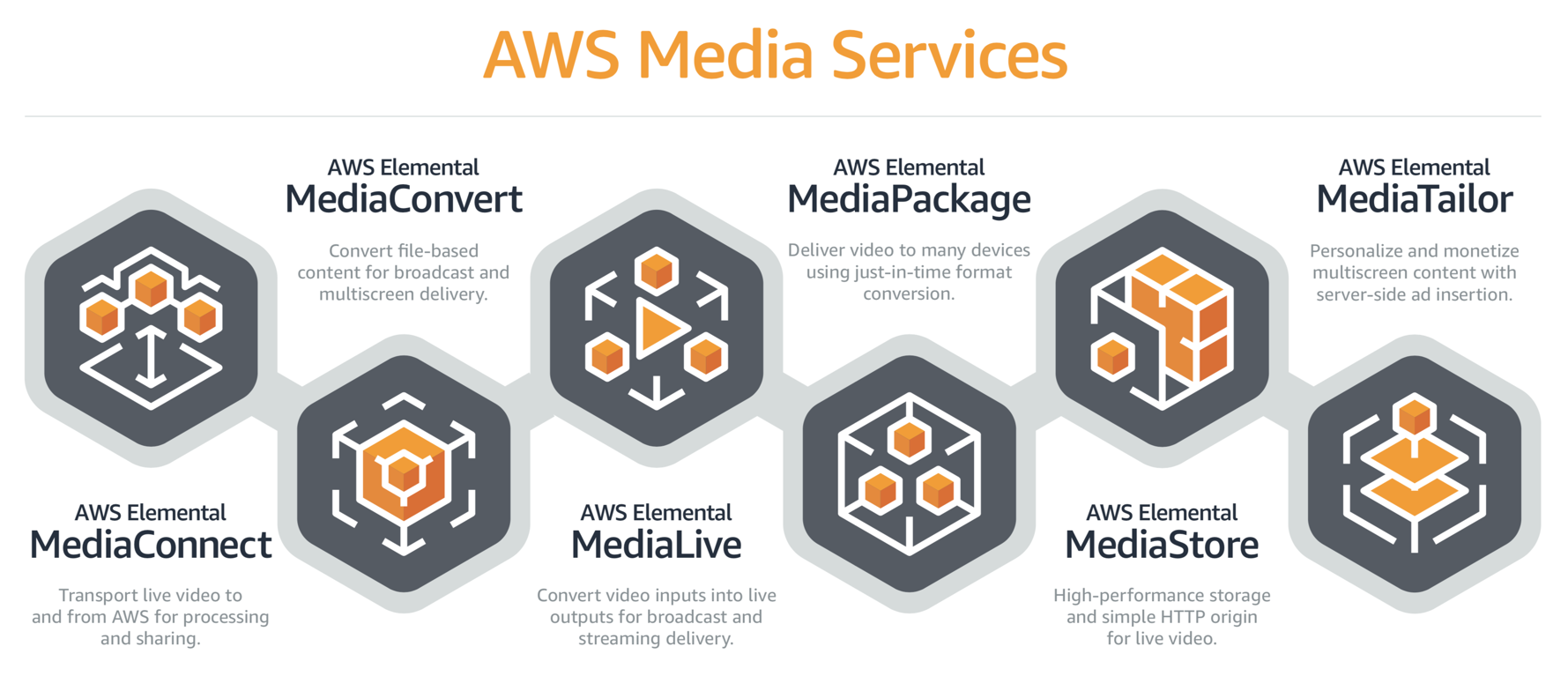

In general, a number of AWS services are required for faultless live or online broadcasting. AWS is useful for everything from video encoding to compressing it for delivery. AWS Elemental MediaConvert and media live are also helpful in offering the best streaming option.

Your business still has to be improved, regardless of whether you have a fast website or a feature-rich application. Here, you will benefit from utilising the outstanding AWS services. To speed up video streaming, you must choose between AWS MediaConvert and Elemental MediaLive. Instead, employing both of them ensures perfect video streaming.