The insurance request is a top influencer within the global frugality. Businesses, ordinary citizens, healthcare associations, and indeed government institutions all need kinds of insurance. But despite the substantial size of the request, the current insurance system is big and lacks fellowship between parties and stakeholders. Building smart contracts for insurance rather than drafting inconvenient paper agreements can change this situation.

What are smart contracts and does the business world really need them?

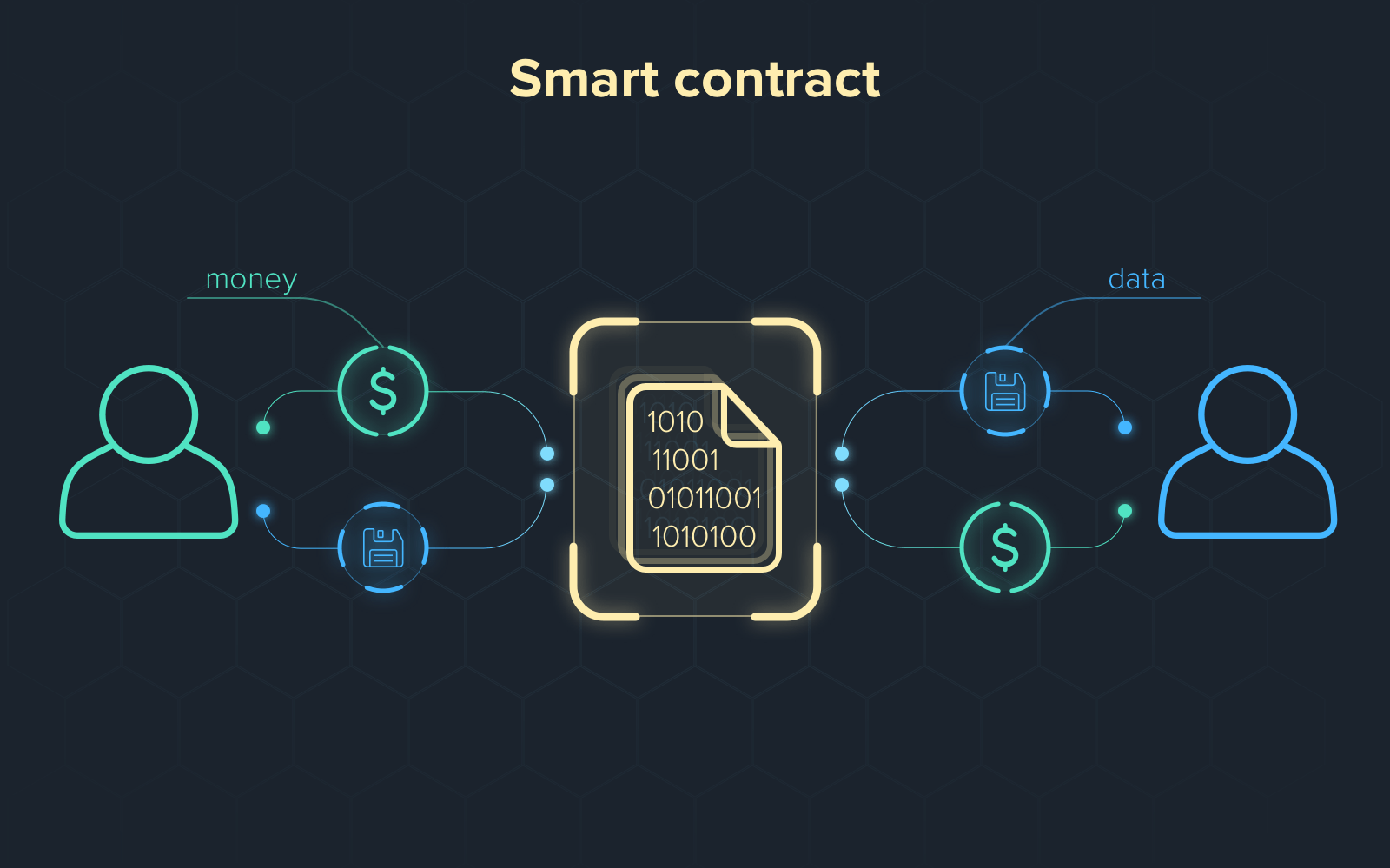

Smart contracts are a blockchain– enabled miracle that’s formerly made an impact on the business world. A computer program that sets the terms of an agreement, a smart contract automatically enforces the agreement when pre-defined rules are met.

To understand the substance of smart contracts, we’ve to understand the part of the blockchain first. Indeed though Bitcoin is generally the first thing that pops into people’s minds when they hear blockchain, there are other ways to use the technology.

Thanks to blockchain technology, data can be stored in a distributed manner. This means that all deals are automatically operated through the law, banning any third- party intruding into the agreement.

Offering security and trustability, a blockchain makes sure that each sale is executed and ca n’t be changed. Each chain automatically follows after the former one to perform a sale. Generally, Ethereum is the platform used to produce smart contracts and execute them.

How smart contracts work in blockchain

According to data from the recent Smart Contracts Market Research Report from Market Research Future, the global smart contracts request will reach roughly$ 300 million by the end of 2023, with a 32% CAGR during the read period from 2017 to 2023.

The global smart contracts request in USD millions

Companies in the banking, government, automotive, healthcare, real estate, and insurance sectors are interested in figuring out how to make smart contracts work for them. Let’s have a look at the advantages of using smart contracts in insurance and the reasons why this sphere needs smart contract advancements further than others.

Blockchain smart contracts in insurance can significantly reduce fraud

Technological dislocation is egging every insurance company to take action and find out how to make smart contracts work for them. The benefits of using smart contracts in insurance assistance are substantial.

lower fraud through translucency. This particular advantage of smart contracts in insurance is possible because of the decentralised and open nature of blockchains. With no proprietor, anyone can see any sale logged in a blockchain database.However, all parties will see it and no inconsistencies will be missed, If any changes to insurance smart contracts are made.

Task robotization. With the blockchain, all smart contract- related processes are automated and rendered securely. barring the need for intercessors and mortal input is the crucial benefit of using smart contract insurance. This lessens the threat of manipulation by third- party actors. Also, applied for smart contracts insurance, blockchain allows companies to review their procedures and processes in a more transparent and accessible way.

Save time on vindicating claims. Blockchain smart contracts in insurance fully replace the claims process. No other documents are demanded, only predefined rules to settle claims. Faster processes, increased effectiveness, and lower costs — nothing but benefits for insurers.

cover policy documents. Insurers can store policy documents on multitudinous checks, making it nearly insolvable to lose them. Thanks to their specialised characteristics, smart contracts help data loss and damage.

threat assessment. Blockchains let insurance companies include state- of- the- art threat assessment models into their smart contracts. This sense relies on a blockchain- grounded ID system. IDs are incontinently vindicated and supplemented with new data, barring the time- consuming stages of traditional identity verification. A smart contract reads all information related to an individual and automatically assesses pitfalls, saving time and trouble on data collection and verification.

Development phases of a smart contract explained for insurance companies

erecting a smart contract is a bit bogarting for the maturity of insurance associations. And for good reason. But if insurers are planning to produce advanced client- centric products, they should know what to anticipate from smart contract development. Without diving into complex specialised matters, the following development phases will help you get a general overview of how to make a smart contract.

Designing a commemorative. For creating smart contracts, the Ethereum network allows druggies to develop their own commemoratives to execute specific functions. The trick then’s to duly determine what functions to execute and what business sense to include.

enforcing the smart contract. Ethereum provides a virtual terrain called the Ethereum Virtual Machine. Ethereum smart contracts are erected using the Solidity programming language, an object contract- acquainted, high- position language especially designed for enforcing smart contracts.

Testing. Smart contracts should be stationed on the blockchain network to run. But this may beget certain difficulties with testing. Autotests are a good result. By emulating a real terrain, autotests corroborate that a smart contract works as anticipated.

Acceptance and review. Indeed though there are no factual verification norms for smart contracts, there are special circumstances for inventors to corroborate their smart insurance law and sense. An honest review and acceptance process should cover cost- effectiveness, including numerous pundits and furnishing visibility of results.

Deployment. Now it’s time to emplace the smart contract to the Ethereum blockchain so that everyone can use it. There are specific tools to speed up deployment, but in general, masterminds have to submit contract law to the blockchain where the sale will stay to be booby-trapped. After it’s booby-trapped, the contract is considered stationed.

Support. An insurance company that operates blockchain technology should have their own or outsourced coffers to maintain the structure of their smart contracts.

Smart contract lifecycle phases

Irrespective of the assiduity, there are four phases within a smart contract’s lifecycle

- Creation. The parties agree on the contract’s contents and objects. Next, the agreement is turned into law via the development phases described over.

- indurating. After a smart contract appears on the blockchain, it becomes public and accessible through the public tally. At this stage, both contractors have to meet all the conditions of the contract, pay a figure, or shoot an asset to execute the blockchain further. Also, transfers made to the portmanteau address defined in the smart contract are formed until all preconditions are met.

- prosecution. When the smart contract executes, it results in new deals that are formerly again stored in the distributed tally. These deals are also validated by the agreement protocol.

- Finalization. A smart contract is considered perfected after means have been defrosted and all deals have been verified.

lustration of a smart contract result for vehicle insurance

According to Capgemini, using smart contracts in the bus insurance assistance could affect in$ 21 billion in periodic cost savings encyclopaedia ally. This is thanks to the benefits of using smart contracts for insurance similar to process robotization and reduced above in claims handling.

Winklix has helped a blockchain incipiency develop a smart contract result for one of the leading European insurance companies. The primary thing of this design was to produce a web app to enable online vehicle insurance policy purchases. As a result, the insurance company entered a suite of largely scalable smart contract results that included a language for defining contract specifications and an operating system for managing and storing insurance smart contracts.

The delivered prototype can ensure vehicles electronically, manage bus insurance history, and automatically submit bus insurance claims. This is just one illustration to prove that insurance assiduity players are ready to learn how to make smart contracts their main competitive advantage.

Constraints of blockchain smart contracts in insurance

Every technology, indeed the most promising, needs time to shape up. The blockchain, with all the hype girding it, is still frequently miskew. The same is true of how to make smart contracts a bulletproof universal result for businesses. Then there are some of the enterprises that limit the popularization of smart contracts.

Limited contract compass. The most significant constraint that can spoil the benefits of using smart contracts in insurance is the necessity to cover every eventuality in a contract’s law. effects that can be done fairly fluently on paper can be delicate to restate into law. Especially because the maturity of companies start erecting smart contracts with the simplest models, using the pattern if X occurs, also Y will be.

Technological complexity. erecting a sophisticated blockchain smart contract in insurance requires a particular position of programming chops. First of all, only specialists well- clueed in Ethereum can produce a well- run smart contract. Naturally, it’s quite a gruelling task since the technology is relatively complicated and involves an in- depth understanding of software development.

Possible bugs in law. Smart contracts are tricky. Since they ’re executed successionally, if at least one vital piece is missing, the contract wo n’t run. Indeed though the elimination of the mortal input is among the top advantages of smart contracts in insurance, smart contracts still bear mortal involvement at the development stage. And do n’t forget that to err is mortal.

Query of legal regulations. It’s no secret that insurance assistance is among the most regulated. But despite the keen interest in blockchain technology shown by government institutions, smart contracts are still largely limited. So how to make a smart contract and use it in insurance in a fairly sound way remains unclear.

Smart contracts are not a mature technology, but it’s clear that the broader use of the blockchain is formally changing the custom insurance software. With smart contracts, insurers will be suitable to automate their programs and services, reduce executive and claims processing costs, increase translucency, and help fraud. Winklix supports innovative trials and is ready to help apply blockchain technology and smart contracts in particular.