In 2026, AI mobile app development in Delhi has become one of the fastest-growing sectors in India’s digital economy. Businesses across Delhi NCR, Gurgaon, and Noida are integrating Artificial Intelligence (AI), Machine Learning (ML), Generative AI, predictive analytics, and automation into mobile applications to gain competitive advantage.

Whether you are a startup founder, enterprise CTO, or product leader, investing in AI-powered mobile app development in Delhi can significantly boost revenue, customer retention, and operational efficiency.

Why AI Mobile App Development in Delhi is Growing Rapidly

Delhi NCR has evolved into a major technology hub alongside cities like:

- Bengaluru

- Hyderabad

- Mumbai

- Noida

Key drivers behind this surge include:

- Increased funding for AI startups

- Demand for AI automation in enterprises

- Rapid growth in FinTech and HealthTech

- Adoption of Generative AI tools

- Strong IT infrastructure in NCR region

Businesses are no longer building basic apps — they are building AI-first mobile applications.

Top AI Mobile App Development Trends in Delhi (2026)

Generative AI Mobile Apps

4 Trending AI features include:

- AI chatbots for customer service

- AI content generators

- Voice-enabled AI assistants

- AI-driven CRM automation

Industries adopting generative AI apps:

- EdTech

- FinTech

- Real Estate

- E-commerce

2️⃣ AI-Powered E-commerce & D2C Apps

4 AI improves:

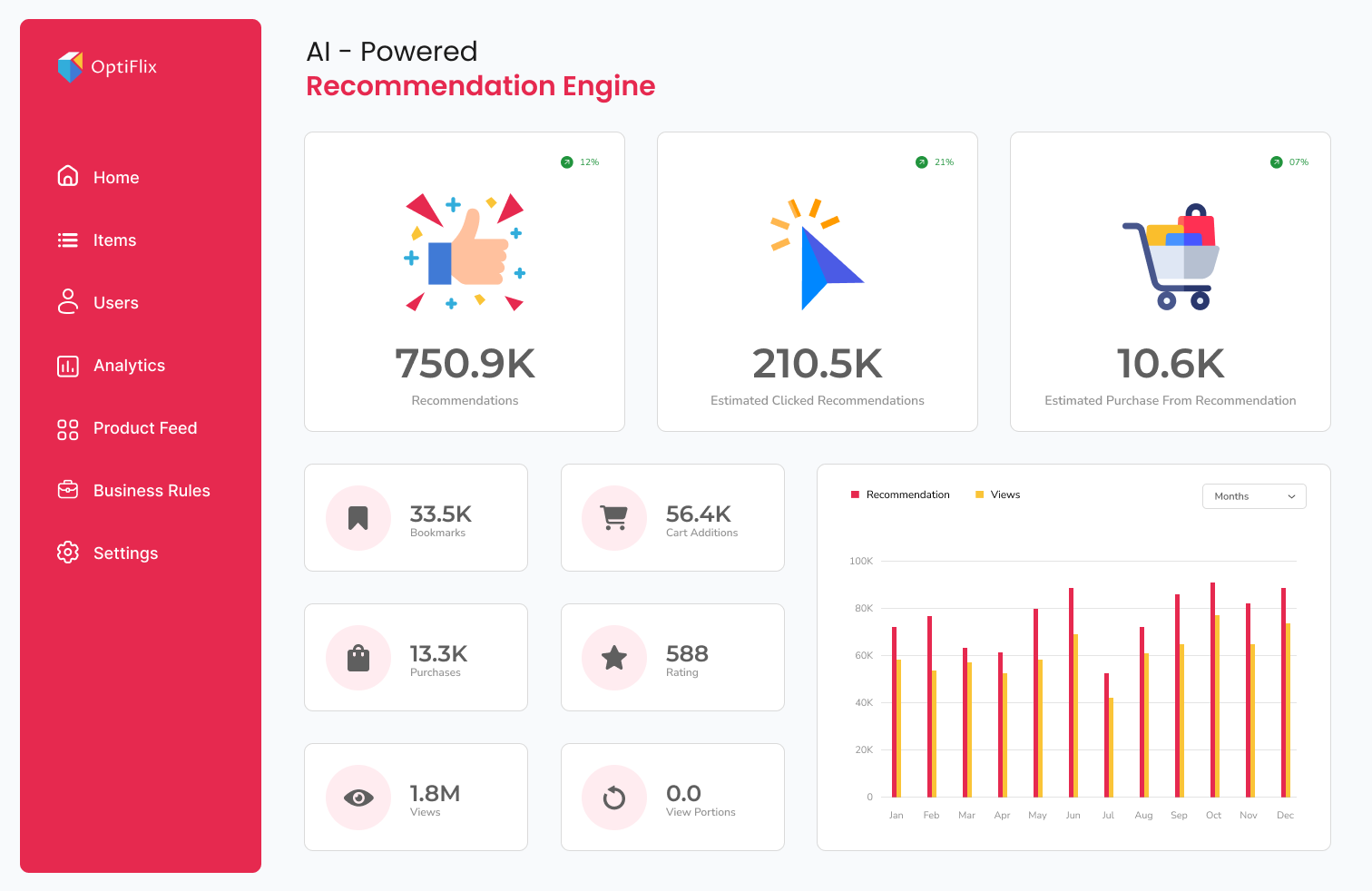

- Personalized recommendations

- Smart search results

- Predictive purchasing behavior

- Dynamic pricing models

Conversion rates can increase by 30–45% when AI is implemented strategically.

3️⃣ AI in Healthcare & Telemedicine Apps

4 Delhi healthcare startups are investing in:

- AI symptom checkers

- Predictive health analytics

- AI-powered patient engagement

- Medical image recognition

Compliance with data privacy laws is crucial in this sector.

4️⃣ AI in FinTech & Banking Apps

FinTech AI features include:

- Real-time fraud detection

- Automated credit scoring

- AI financial advisors

- Risk management dashboards

Technology Stack for AI Mobile App Development in 2026

Businesses should look for expertise in:

- React Native

- Flutter

- Swift

- Kotlin

- Python (AI backend)

- TensorFlow

- PyTorch

- OpenAI APIs

- AWS AI Services

- Microsoft Azure AI

Enterprise integrations:

- Salesforce

- SAP

- ERP systems

💰 Cost of AI Mobile App Development in Delhi (2026)

| App Type | Estimated Cost (INR) |

|---|---|

| AI Chatbot App | ₹8 – 15 Lakhs |

| AI E-commerce App | ₹20 – 45 Lakhs |

| AI Healthcare App | ₹25 – 60 Lakhs |

| Enterprise AI Platform | ₹50 Lakhs – 2 Crore+ |

Cost depends on:

- AI model complexity

- Cloud hosting

- Security compliance

- UI/UX design

- Integration requirements

Compliance & Data Security in 2026

Businesses must ensure compliance with:

- GDPR

- India’s Digital Personal Data Protection Act

- Secure cloud architecture

- Ethical AI guidelines

- End-to-end encryption

Non-compliance can lead to heavy financial penalties.

ROI of AI Mobile Apps

Companies implementing AI mobile apps are reporting:

- 25–40% operational cost reduction

- 30% improvement in customer engagement

- Faster decision-making using predictive analytics

- Improved automation and reduced manual workload

AI mobile apps are becoming revenue-generating digital assets.

Frequently Asked Questions (FAQ)

1. What is AI mobile app development?

AI mobile app development involves integrating Artificial Intelligence technologies like Machine Learning, predictive analytics, and Generative AI into Android and iOS applications to automate processes and improve user experience.

2. How much does AI mobile app development cost in Delhi?

The cost ranges from ₹8 Lakhs to ₹2 Crore+, depending on complexity, AI models used, integrations, and scalability requirements.

3. How long does it take to develop an AI mobile app?

Basic AI apps take 3–4 months, while enterprise-level AI platforms may take 6–12 months depending on features and integrations.

4. Which industries benefit most from AI mobile apps?

- Healthcare

- FinTech

- E-commerce

- Logistics

- Real Estate

- EdTech

5. Is AI mobile app development suitable for startups?

Yes. Startups can begin with MVP-based AI apps and scale gradually using cloud-based AI models and APIs.

6. How do I choose the best AI mobile app development company in Delhi?

Look for:

- AI expertise and real case studies

- Strong backend engineering

- Cloud & DevOps capabilities

- Security compliance knowledge

- Post-launch AI optimization support

Final Thoughts

In 2026, AI mobile app development in Delhi is no longer optional — it is a strategic investment. Businesses that adopt AI-powered apps early will lead in automation, customer personalization, and revenue growth.